Frozen Food Processing Machinery Market Set to Surge USD 33.48 Billion by 2034 | Towards FnB

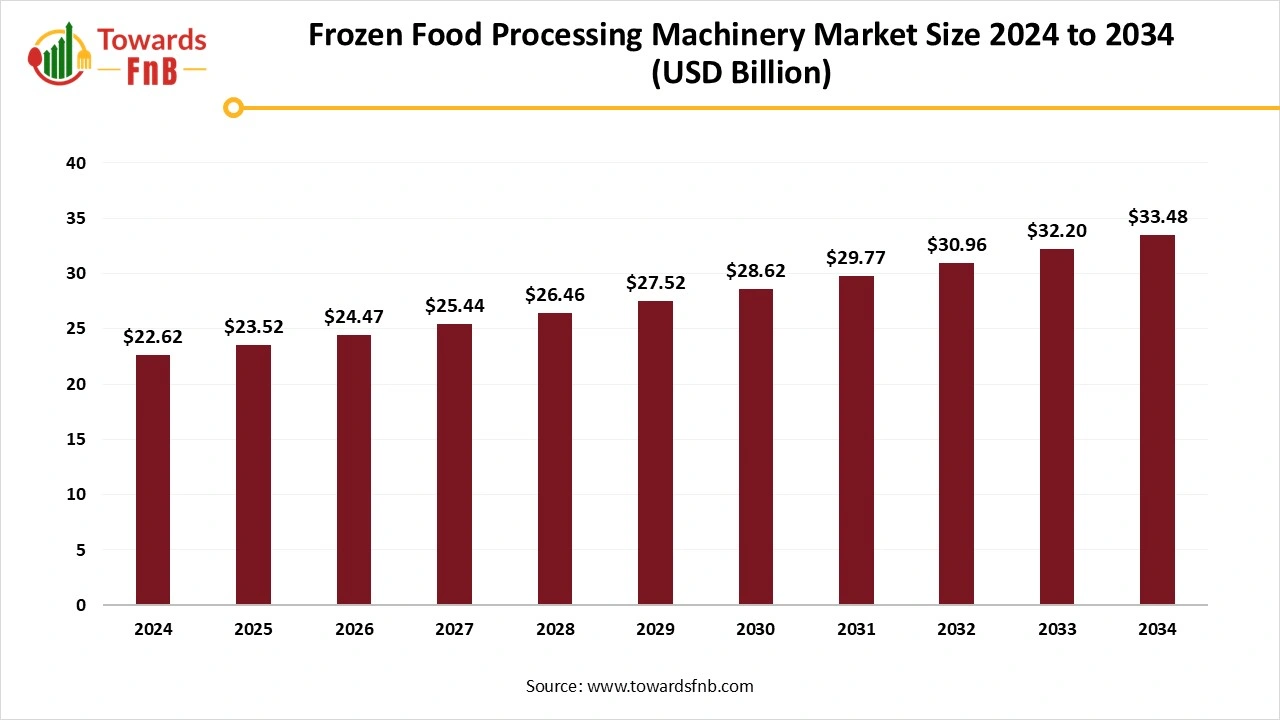

According to Towards FnB, the global frozen food processing machinery market size is calculated at USD 23.52 billion in 2025 and is anticipated to surge USD 33.48 billion by 2034, reflecting at a CAGR of 4% from 2025 to 2034. This surge is primarily driven by the growing demand for convenient, ready-to-eat frozen foods and the widespread adoption of automation and innovative freezing technologies.

Ottawa, Nov. 07, 2025 (GLOBE NEWSWIRE) -- The global frozen food processing machinery market size stood at USD 22.62 billion in 2024 and is predicted to increase from USD 23.52 billion in 2025 to reach nearly USD 33.48 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research. As consumer preferences shift towards healthier, convenient meal solutions, and new technologies continue to enhance food quality and shelf life, the market is poised for exponential growth.

The market is expected to grow due to higher demand for convenient, ready-to-eat frozen food options. Advanced technologies, higher demand for hygienic equipment, and increased automation of major procedures also help fuel the market’s growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5899

Key Highlights of Frozen Food Processing Machinery Market

- By region, North America dominated the market with the highest share of 35% in 2024. However, the Asia Pacific region is expected to grow the fastest during the forecast period, while Europe is anticipated to experience notable growth in the same period.

- By equipment, the freezing equipment segment held a major market share of 34% in 2024. The others (Automation & Inspection Systems) segment, which includes advanced automation technologies, is projected to grow at a CAGR between 2025 and 2034.

- By food, the meat, poultry, and seafood segment led the market with 33% of market revenue in 2024. However, the ready meals segment is expected to grow at a significant CAGR between 2025 and 2034.

- By process, the IQF (Individually Quick Frozen) segment held a dominant market share of around 29% in 2024. The cryogenic freezing segment, on the other hand, is projected to see steady growth from 2025 to 2034.

- By automation level, the semi-automated system segment held a substantial market share of approximately 42% in 2024. The fully automated system segment, though currently smaller, is projected to grow steadily over the next decade (2025–2034).

- By end use, the food processing companies held the largest market share of approximately 46% in 2024. The restaurants and foodservice chains segment is expected to experience steady growth between 2025 and 2034.

Technological Improvements are Helpful for the Growth of the Frozen Food Processing Machinery Industry

The frozen food processing machinery market is expected to grow due to factors such as rising demand for convenient food options, advances in freezing technology, and heightened food safety standards. The market uses machinery to freeze and maintain the quality and shelf life of food and beverages, which supports market growth.

The method also helps to maintain the nutritional value of products, further fueling the market’s growth. The market is also seeing growth driven by higher demand for frozen, convenient, and plant-based food and beverage options, with extended shelf life helping busy consumers.

Advanced Technological Methods fueling the Market’s Growth

- Automation and Robotics - They help perform tasks with precision, such as cutting, sorting, and packaging, thereby improving speed, efficiency, and work quality.

- AI and ML- Artificial intelligence and machine learning help to enhance the quality of work and improve efficiency. AI-controlled operations help to manage the efficiency and predict quality outcomes.

- Cryogenic Freezing- The technologically advanced method uses extremely low temperatures for rapid freezing, maintaining food quality and shelf life. It also helps to minimize crystal formation while maintaining the food quality.

- Modified Atmosphere Packaging (MAP) - The procedure involves replacing the air inside the packaging with a special gas mixture. It helps enhance the product's shelf life and maintain its quality.

Impact of AI in the Frozen Food Processing Machinery Market

Artificial intelligence has a major impact on the frozen food processing machinery market by improving automation, precision, and operational efficiency throughout the production process. In manufacturing, AI-powered predictive analytics optimize machinery performance by monitoring temperature, pressure, and processing speed in real time. This ensures consistent product quality, reduces downtime through predictive maintenance, and lowers energy consumption. Machine learning algorithms analyze production data to fine-tune freezing, cutting, and packaging processes, improving yield and minimizing waste.

Computer vision systems are enhancing quality control by detecting imperfections, contamination, or irregularities in frozen products, ensuring compliance with food safety standards. AI-driven robotics and automated handling systems are increasing line efficiency and reducing reliance on manual labor, particularly in sorting, portioning, and packaging. In addition, AI helps equipment manufacturers design smarter, more adaptive machinery that can automatically adjust settings based on product type or environmental conditions.

New Trends of Frozen Food Processing Machinery Market

- Enhanced and advanced technology is one of the major trends driving market growth, enhancing the speed and efficiency of manufacturing.

- Technologically advanced methods, such as cryogenic freezing, help to maintain the quality of products and enhance their shelf life, which is another major factor for the growth of the market.

- Higher demand for meat-based snacks, convenient food options, and higher demand for plant-based snacks are other major factors for the growth of the market.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/frozen-food-processing-machinery-market

Recent Developments in the Frozen Food Processing Machinery Market

- In April 2025, Fujitsu Limited and Sonofai Inc., Ishida Tec Co., Ltd., and Tokai University announced the launch of an automated inspection device that can determine the fat content of frozen albacore tuna in a non-destructive manner. The device is equipped with Fujitsu’s AI technology and is launched by Sonofai Inc. (Source- https://www.fujitsu.com)

- In May 2025, Falcon Agrifriz Foods Private Limited launched its cutting-edge frozen potato production plant in Kadi, Gujarat. The plant was officially inaugurated by the Home Minister and Minister of Cooperation, Mr. Amit Shah. (Source- https://themachinemaker.com)

Product Survey: Global Frozen Food Processing Machinery Market

| Product Category | Description / Function | Common Machinery Types / Variants | Key Applications / End-Use Segments | Leading Manufacturers / Brands |

| Freezing Equipment | Core machinery that lowers food temperature rapidly to preserve texture, flavor, and nutrition. | Spiral freezers, tunnel freezers, blast freezers, plate freezers, cryogenic freezers (using liquid nitrogen/CO₂) | Frozen fruits, vegetables, meat, seafood, bakery, and ready meals | GEA Refrigeration, Bühler AG, JBT (Frigoscandia), Linde plc, Mayekawa (MYCOM), Starfrost (UK) |

| IQF (Individual Quick Freezing) Systems | Specialized equipment freezes individual food items separately to maintain quality and prevent clumping. | Fluidized bed IQF systems, belt freezers, cryogenic IQF | Fruits, vegetables, shrimp, meat portions, pasta, berries | GEA Group, RMF Freezers, Starfrost, Air Liquide (ALFI Technologies), OctoFrost |

| Packaging Machinery for Frozen Foods | Machines for sealing, labeling, and portioning frozen goods in consumer-ready formats. | Vertical form-fill-seal, vacuum sealers, tray sealers, shrink-wrap systems | Frozen ready meals, vegetables, seafood, snacks | MULTIVAC, ULMA Packaging, Bosch Packaging, Ishida, Omori Machinery |

| Coating, Battering & Breading Equipment | Used to apply coatings or batters before freezing to enhance texture and flavor. | Batter mixers, breading lines, enrobing systems | Frozen meat, fish, nuggets, and appetizers | Marel, JBT FoodTech, GEA, Heat and Control |

| Cutting & Slicing Machinery | Prepares food into uniform sizes prior to freezing for efficiency and quality consistency. | Dicers, slicers, choppers, portion cutters | Vegetables, meat, bakery, seafood | Urschel Laboratories, FAM Stumabo, Bettcher Industries |

| Blanching & Cooking Equipment | Machines that pre-treat food to deactivate enzymes before freezing. | Steam blanchers, water blanchers, continuous blanchers | Vegetables, fruits, pasta, seafood | Bühler AG, Lyco Manufacturing, Cabinplant |

| Mixing & Forming Equipment | Prepares uniform food mixtures or shaped products for freezing. | Mixers, tumblers, and forming presses | Meat patties, dough, frozen meals, bakery | Marel, GEA Group, Provisur Technologies |

| Glazing & Coating Systems | Provide protective ice or sauce layers on frozen products to retain moisture and extend shelf life. | Immersion glazing, spray glazing, sauce applicators | Frozen fish, seafood, desserts, and vegetables | Starfrost, OctoFrost, GEA Refrigeration Technologies |

| Conveying & Material Handling Systems | Transport food between freezing, coating, and packaging stages; designed for low-temperature operation. | Belt conveyors, spiral conveyors, palletizing systems | Integrated processing lines, cold storage plants | GEA, Bühler, Mayekawa, JBT |

| Cold Storage & Refrigeration Units | Maintain consistent freezing temperatures during storage and logistics. | Blast chillers, cold rooms, ammonia/CO₂ refrigeration systems | Frozen warehouses, distribution centers | Linde plc, Mayekawa, GEA Refrigeration Technologies, Danfoss |

| Control & Automation Systems | Digital control units ensure consistent freezing parameters, energy efficiency, and food safety. | PLC systems, IoT sensors, SCADA automation, AI-enabled monitoring | Smart factories, Industry 4.0 food processing lines | Siemens, Rockwell Automation, Schneider Electric, GEA Group |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5899

Trade Analysis: Frozen Food Processing Machinery Market: Import & Export Statistics

Who are the Major Exporters/Manufacturing Origins?

- Germany / Netherlands / Italy — European engineering houses and machinery clusters remain dominant exporters of food-processing and freezing equipment. German machinery exports for food processing and packaging reached record levels recently, illustrating Europe’s global manufacturing strength and after-sales service footprint. European suppliers are often selected for turnkey plant installations and high-throughput lines.

- United States — U.S. firms are strong in specialized freezing lines, portioning, and integrated packaging/automation systems, and export widely to the Americas, Asia and the Middle East. U.S. shipments are commonly routed through nearshore servicing partners and regional OEM agreements.

- China — China supplies cost-competitive freezing equipment and small-to-midscale IQF lines; its role is especially pronounced for emerging-market buyers seeking lower CAPEX options and for private-label frozen-food manufacturers. China’s share in food-machinery shipments has grown with scale manufacturing and platform trade channels.

- Denmark / Netherlands / Sweden / Belgium (specialists) — smaller European players and Nordic engineering firms are important for niche equipment (glazing ovens, portioners, fish/seafood processing) and often act as subcontractors to larger exporters.

Key Importers/Demand Centres

- Asia-Pacific (China, Japan, South Korea, Southeast Asia) — the largest and fastest-growing market for frozen-food machinery as frozen retail and foodservice expand across urbanizing populations; buyers import both turnkey Western lines and Chinese mid-range equipment depending on budget and scale.

- North America (U.S. & Canada) — strong demand for high-automation, high-hygiene equipment for seafood, poultry and ready-meal processors; imports skew toward U.S./EU vendors for premium lines and toward China for secondary/OEM parts.

- Europe (Germany, Netherlands, UK) — big internal market for processing lines (intra-EU trade) and re-exports of packaged frozen products; EU buyers balance domestic suppliers with imports for specialized functions.

- Middle East & Africa / Latin America — growing markets for lower-to-mid CAPEX freezing lines to support retail frozen categories and cold-chain expansion.

Trade Flows & Typical Transaction Patterns

- Turnkey projects dominate high-value trade. Large buyers typically import whole production lines (freezers + portioning + glazing + IQF + packaging) as CAPEX project contracts; these shipments include machinery, engineering services, commissioning and spare-parts agreements. European and U.S. suppliers often win these contracts based on total cost of ownership, certification and service capability.

- Component / retrofit trade is large. Smaller shipments (freezers, spiral freezers, conveyors, IQF tunnels) are often imported separately for line upgrades or local assembly. China and regional OEMs supply many of these components.

-

After-sales service and local partners shape competitiveness. Export success depends heavily on local installation, spare parts availability and service contracts; markets with poor local service favor exporters who provide long-term support. (Industry players' list emphasizes service networks.)

Trade Drivers & Current Pressures

- Frozen-category growth (seafood, poultry, RTE meals) is the primary demand engine for machinery imports; retail expansion into frozen sections and foodservice central kitchens push processors to invest.

- Energy & efficiency regulations push buyers toward newer equipment with lower energy consumption and improved refrigeration systems, this can favor modern European designs that emphasize efficiency.

- Supply-chain & shipping cost volatility affects where buyers source equipment; longer lead times and higher freight costs can tilt buyers to regional suppliers or to purchasing components for local assembly.

- Automation & labor substitution: processors in high-wage countries prefer automated lines that reduce labor needs, which advantages suppliers offering robotics and end-of-line automation.

Government Initiatives & Policy Influences

- Export & industrial support in machinery hubs (Germany / Netherlands / Italy): government-level trade promotion, engineering clusters and trade missions help European suppliers secure overseas processing projects; national machinery associations actively promote standards and buyer matching.

- Investment incentives in importer markets: several countries offer tax or investment incentives for food-processing capacity expansion (e.g., special economic zones, cold-chain grants), which stimulate imports of processing machinery. National trade/industry portals and export promotion bodies often provide matchmaking for these projects.

-

Trade facilitation & standards: harmonized sanitary and food-safety standards (EU hygiene directives, FDA/US standards) shape buyer choice, suppliers that can certify compliance with importers’ standards win larger contracts.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Frozen Food Processing Machinery Market Dynamics

What Are the Growth Drivers of the Frozen Food Processing Machinery Market?

The frozen food processing machinery market is burgeoning due to factors such as higher demand for frozen and convenience food options, advances in freezing technology, and improvements in the flavor, texture, and appearance of frozen foods. Higher demand for plant-based food options is another vital factor driving market growth. Automated and robotic systems, which improve the quality and efficiency of work, also support market growth.

Challenge

Technological and Equipment Costs Obstructing the Market’s Growth

Factors such as upfront costs of installing advanced machinery equipped with AI and IoT, the need for expertise to operate such machinery, and the need to maintain food and beverage quality with the help of such machinery may obstruct the market's growth. Maintaining sustainability throughout the entire procedure is another major factor hindering the market's growth.

Opportunity

Higher Technological Demands are Helpful for the Market’s Growth

Use of smart, advanced technology and machinery involving robotics, AI, and IoT to improve freezing and maintain the quality of food and beverages, further fueling the market's growth. The technological improvements also help maintain sustainability by deploying eco-friendly, energy-efficient freezing technology, further fueling market growth. The growing technology also helps in product customization, thereby maintaining product quality, further fueling the market's growth.

Frozen Food Processing Machinery Market Regional Analysis

North America Led the Frozen Food Processing Machinery Market in 2024

North America dominated the market in 2024, mainly due to technological advancements, such as AI-powered analytics and cryogenic freezing, higher demand for efficient, automated procedures, rising investment in such machinery, and greater demand for sustainable machinery. The US plays a major role in the regional market's growth due to higher demand for convenient, ready-to-eat food options, technological advancements, and strict government food safety regulations, further fueling the market's growth.

Asia Pacific Is Observed to Be the Fastest-Growing Region

Asia Pacific is expected to be the fastest-growing region over the foreseeable period due to rapid urbanization, changing consumer lifestyles, rising disposable incomes, and higher demand for convenient, ready-to-eat food options. Higher demand for plant-based foods from vegans and health-conscious consumers also helps fuel market growth. Countries such as India, China, Japan, and South Korea are expected to make a major contribution to market growth over the foreseeable period due to higher demand for convenient food options in these regions. The market is also seeing growth driven by technological advancements and improved cold chain infrastructure in the regions.

Europe is Expected to Grow at a Notable Rate in the Foreseeable Period

Europe is expected to experience notable growth over the forecast period due to advancing technology, higher demand for convenient and frozen food options, and improved cold chain logistics. Higher demand for plant-based food options also drives market growth. The UK, France, and Germany help propel market growth in the region through the development of advanced frozen food processing machinery and the higher demand for frozen, convenient food options.

Frozen Food Processing Machinery Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 4% |

| Market Size in 2025 | USD 23.52 Billion |

| Market Size in 2026 | USD 24.47 Billion |

| Market Size by 2034 | USD 33.48 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Frozen Food Processing Machinery Market Segmental Analysis

Equipment Analysis

The freezing equipment segment led the frozen food processing machinery market in 2024 due to higher demand across various domains. The segment focuses on maintaining the food and beverage quality, shelf life, avoiding dehydration, and maintaining the flavor and texture of different food options. The segment also ensures product shelf life, which is helpful for long-haul transportation and export.

The others (automation and inspection systems) segment is expected to grow in the expected timeframe as the segment provides an array of benefits to the market, such as increased automation, perfection, reduced wastage, improved work quality, increased efficiency, safety, and hygiene, and managing the increasing demand for frozen food by maintaining a smooth supply chain.

Food Analysis

The meat, poultry, and seafood segment led the frozen food processing machinery market in 2024, driven by rising demand for animal-based protein sources and a variety of animal-based food options. The segment focuses on maintaining the freshness, quality, flavor, texture, and color of a variety of meat options, which is helpful for the growth of the frozen food processing machinery industry. The segment helps manage consumer demand by extending the shelf life of meat cuts and maintaining freshness and quality, further fueling market growth.

The ready meals and convenience foods segment is expected to expand in the forecast period due to higher consumer demand from those with hectic lifestyles. Ready-to-eat and ready-to-prepare food options allow consumers to save time on prolonged cooking and also provide their bodies with nutritious food. Such food options are also in high demand due to factors such as rapid urbanization, busy lifestyles, and increased demand for plant-based meals. Enhancing technology also aids the market by maintaining the quality and freshness of products.

Process Analysis

The Individual Quick Freezing (IQF) segment dominated the frozen food processing machinery market in 2024 due to factors such as high demand for non-seasonal food and beverage options, the need to maintain the quality and freshness of various foods and beverages, expanding the cold chain and infrastructure, and rising technological advancements.

The cryogenic freezing (liquid nitrogen/CO2) segment is expected to grow in the foreseen period due to multiple benefits, such as improved food quality and safety, extended shelf life, use of improved technology, increased productivity, and higher demand for improved cold chain and logistics, further fueling the growth of the market. The increasing focus on sustainability is also a major factor driving market growth.

Automation Level Analysis

The semi-automated system led the frozen food processing machinery market in 2024 due to improved safety, enhanced automation, and a low initial investment, fueling the industry's growth. The segment is beneficial for companies that need to improve their work quality and speed to meet the growing market demands. Other beneficial factors in the segment that support the market’s growth include improved efficiency, product quality, smooth workflow, automation, and cost-efficiency.

The fully automated system is expected to grow over the foreseeable period due to the convenience it offers. Automated systems allow manufacturing companies to streamline the entire process, reduce the risk of errors, improve efficiency, enhance work and product quality, and lower operational costs. Another advantage of the segment is enhanced product quality and manufacturing speed, which will help market growth in the foreseeable future. AI and robotics help in tasks such as packaging, cutting, freezing, and peeling, further fueling the growth of the market.

End Use Analysis

The food processing companies segment led the frozen food processing machinery market in 2024 due to its higher demand by the food and beverage industry. The frozen food processing machinery helps to maintain the quality, shelf life, freshness, and flavor of food and beverages. The segment also fuels market growth by maintaining a smooth supply chain and meeting the growing demand.

The restaurants and foodservice chains segment is expected to grow over the foreseeable period due to strong demand. Frozen food processing machinery helps to ensure the safety and quality of food and beverages. It helps maintain the freshness and enhance the shelf life of food and beverage products in stores, which helps fuel the market’s growth in the foreseeable period. Higher demand for dining-out culture due to consumers' hectic lifestyles also helps fuel the market's growth in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Frozen Food Processing Machinery Market

- The Middleby Corporation – The Middleby Corporation designs and manufactures advanced food processing equipment, including freezing and chilling systems for frozen food production. Its solutions emphasize automation, energy efficiency, and hygiene, serving sectors such as ready meals, bakery, and protein processing.

- FRIGOSCANDIA (JBT brand) – FRIGOSCANDIA, a brand under JBT Corporation, specializes in industrial freezing technology, including spiral freezers, IQF (individually quick frozen) systems, and impingement freezers. The company’s innovations in hygienic design and airflow control support high-efficiency freezing for poultry, seafood, and bakery applications.

- Air Liquide (ALFI Technologies) – Air Liquide, through ALFI Technologies, offers cryogenic freezing and cooling solutions using liquid nitrogen and carbon dioxide. Its equipment provides rapid and uniform freezing while maintaining product texture and quality for meat, seafood, and bakery producers.

- Cryogenic Equipment & Services (CES) – CES designs and manufactures cryogenic freezing systems utilizing liquid nitrogen and CO₂ technologies. The company provides customized freezing tunnels and spiral freezers that deliver fast freezing with reduced product dehydration.

- Linde plc – Linde supplies cryogenic freezing and chilling systems using advanced gas technologies. Its CRYOLINE range offers efficient freezing for meat, seafood, and convenience foods, with a focus on maintaining food quality and production throughput.

- Bühler AG – Bühler provides high-performance food processing and freezing machinery for various sectors, including bakery, confectionery, and ready-to-eat meals. The company integrates automation, energy optimization, and hygienic design in its cooling and freezing equipment lines.

- GEA Refrigeration Technologies – GEA designs industrial refrigeration and freezing systems that ensure product quality and safety throughout frozen food processing. Its spiral and tunnel freezers are widely used in the dairy, poultry, and bakery industries, emphasizing sustainable, energy-efficient operations.

- Mayekawa Mfg. Co. Ltd. (MYCOM) – Mayekawa, known for its MYCOM brand, provides industrial refrigeration compressors and freezing systems. The company’s equipment supports efficient cold chain management and high-capacity freezing for meat, seafood, and processed food manufacturers.

- Starfrost (UK) Ltd. – Starfrost develops mechanical and spiral freezing systems for food processors worldwide. Its solutions are tailored for frozen seafood, poultry, bakery, and ready-meal applications, integrating energy-efficient refrigeration and customizable design options.

- RMF Freezers – RMF Freezers manufactures industrial spiral and impingement freezing systems for the frozen food sector. The company focuses on reliability, easy maintenance, and consistent product quality across high-volume food processing operations.

- OctoFrost Group AB – OctoFrost specializes in IQF technology, providing fluidized freezing systems designed to preserve natural product appearance and texture. The company’s energy-efficient and hygienic design caters to fruit, vegetable, seafood, and poultry processors.

- Avestia Equipment – Avestia manufactures and supplies freezing machinery and refrigeration equipment for food processing. The company provides modular systems that support efficient freezing, cooling, and storage of diverse food products in large-scale facilities.

- Kuhlmann Refrigeration – Kuhlmann Refrigeration offers industrial freezing and cooling systems tailored for frozen food processing. Its expertise lies in designing energy-optimized refrigeration systems for consistent temperature control and product preservation.

- FPS Food Process Solutions Corp. – FPS specializes in custom-engineered freezing and cooling systems for food processing industries. Its product line includes spiral, tunnel, and IQF freezers designed for efficiency, sanitation, and high throughput in global frozen food production.

- Scanico A/S (Marel Group) – Scanico, part of the Marel Group, produces spiral and impingement freezers with advanced air circulation and hygienic design. Its equipment is widely used for poultry, meat, and bakery products, offering flexibility and reliable freezing performance.

- Stalam S.p.A. – Stalam develops radio frequency and microwave-based industrial freezing and drying systems. Its technologies are designed to improve energy efficiency and reduce processing time while maintaining product quality and safety.

-

Vemag Maschinenbau GmbH – Vemag Maschinenbau manufactures forming, portioning, and freezing systems for the meat and convenience food industries. The company’s integrated machinery enables continuous production lines combining forming, freezing, and packaging stages.

Segments Covered in the Report

By Equipment Type

- Freezing Equipment (Blast, Spiral, IQF, Cryogenic)

- Pre-Processing Equipment (Cutting, Slicing, Washing, Peeling)

- Packaging Equipment (Vacuum, Flow Wrap, Tray Sealers)

- Coating & Battering Equipment

- Glazing & Dehydration Systems

- Others (Mixers, Conveyors, Inspection & Sorting Systems)

By Food Type

- Meat, Poultry & Seafood

- Fruits & Vegetables

- Bakery & Confectionery

- Dairy Products

- Ready Meals & Convenience Foods

- Others (Plant-Based & Specialty Frozen Foods)

By Process Type

- Individual Quick Freezing (IQF)

- Cryogenic Freezing (Liquid Nitrogen/CO₂)

- Mechanical Freezing (Blast, Belt, Tunnel)

- Batch vs Continuous Processing Lines

- Hybrid & Advanced Systems (Energy Efficient & Sensor-Enabled)

By Automation Level

- Semi-Automated Systems

- Fully Automated & Robotic Systems

- Manual/Conventional Equipment

By End Use

- Food Processing Companies

- Frozen Food Manufacturers (Private Labels & Brands)

- Cold Chain & Logistics Providers

- Restaurants & Foodservice Chains

- Others (Institutional Catering, Hospitals, Airline)

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5899

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️U.S. Halal Food Market: https://www.towardsfnb.com/insights/us-halal-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.